Why an Index of 7,000 a Real Possibility

It’s a time to take extra caution as we advance into the latest cycle and “keep your head whilst all those around you lose theirs”

by Rod North, Founder & Managing Director, Bourse Communications

What a rollercoaster ride the Australian sharemarket has been on over the past 12 months! With the All Ords peaking in August 2018 following a positive month on both Wall Street and the ASX, investors were suddenly spooked by the political turmoil in Canberra, and the All Ords lost $30 billion in one week to 23rd August. Poor sessions on Wall Street saw US shares sold off heavily ahead of the start of the earnings season, and investors in Australia locked in gains seeing the ASX drop alarmingly through October and November. From the All Ords beginning 2018 at 6,167, it peaked at 6,481 on 30th August and came to a bleak end closing the year out at 5,709 on 31st December.

Since then, the Australian sharemarket has been actively recovering from the market volatility and unpredictability that it encountered over the past year; which suggests that I was sanguinely on point when proposing late last year that investors should be cautiously optimistic for 2019.

In the 143-year history (since 1875) of the Australian sharemarket, after every boom there has been an inevitable bust. Some of these busts, as in the 1987 sharemarket crash, saw the market decline by up to 50 per cent in a very short timeframe. In that case, it was virtually an overnight drop that took the market by complete surprise. Other crashes took longer, like in November 2007, it took until March 2009 to finally reach the bottom of the market.

On a close analysis of the last 100 years of the sharemarket performance, it can generally take between five to seven years to get to the ‘Boom Phase’ of the cycle. Because of the information age and the power of the digital age, and a revolving door of lacklustre country leadership on a local and world scale, the old norms of the nature of the cyclical market have been rewritten for the 21st century.

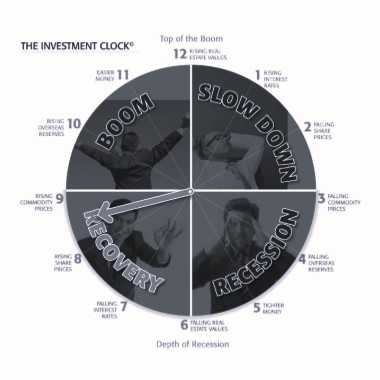

We know that there are certain signs to look for that indicate we are in ‘Boom Phase’ of the Investment Clock cycle, which, in turn, suggests the All Ords Index is set to rise to even loftier heights. And if we were in any doubt, the past six months have made it abundantly clear that we are now in the ‘Boom Phase’ of the Investment Clock.

In November 2007, the market peaked at an intra-day high of 6,873, and a closing high of 6,853, then dropped through the Global Financial Crisis in 2009/10 to a low of 3,109. Since then, the market has slowly risen and yesterday it finally reached and surpassed the November 2007 closing high, ending the day at 6,862. And this morning, 25th July 2019, the market has finally reached and surpassed the all-time inter-day high of 6,873.

There is now enough anecdotal evidence to suggest that the All Ords will to continue to move higher over the remainder of 2019 and into 2020, with the prediction that the market is set to reach 7,000 points by year’s end.

And here’s why:

2019 Half-yearly company earnings results

Of the companies which reported half-year results this February earnings season, 93% posted a profit.Source: CommSec

The second half of 2019 is also shaping up to continue a trend of improved earnings and profitability that will play a part in driving the sharemarket higher.

Increasing dividend payments

Overall, around $29.4 billion will be paid to shareholders over the February-June period, up from $26 billion in the August 2018 reporting season.Source: CommSec

Rise in commodity prices

Over the past year, the index has increased by 12.6 per cent in SDR terms, led by higher iron ore, LNG and, beef and veal prices. The index has increased by 18.3 per cent in Australian dollar terms.Source: Reserve Bank of Australia

Rise in overseas reserves

Foreign Exchange Reserves in Australia increased to 79919 AUD Million in May from 75668 AUD Million in April of 2019.Source: Trading Economics

Lowered Interest Rate

On 4 June 2019 the RBA lowered the cash rate by 25 basis points from 1.50 per cent to 1.25 per cent. This was the first official interest rate move in almost three years. The following month, the RBA again dropped the cash rate by another 25 basis points, taking it to a record low of 1.00 per cent.

(Source: Reserve Bank of Australia)

With the cash rate at this level and likely to go lower, the sharemarket will be a major beneficiary as investors chase yield.

Concerns from 2018 resolved:

Banking Royal Commission

On 4 February 2019, Commissioner Hayne released the final report on The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

Political uncertainty in Australia

On Saturday, 18 May 2019 the Liberal/National coalition won the election with a strong mandate to govern, 77 seats to ALP’s 68 seats. This removed the uncertainty of which party would govern Australia for the next 3 years and confirmed the status quo. Investment markets don’t like uncertainty.

By winning what was seen as an unwinnable election, the unexpected leader has cemented his authority over the Liberal Party, giving him the muscle to end a decade of instability that has seen a revolving door of prime ministers.Source: Reuters, 19 May 2019

On an International front:

Political uncertainty in Europe

The EU and UK have agreed a further delay to Brexit until 31 October. On 7 June Theresa May stood down as prime minister, and on 23 July, Boris Johnson, who campaigned for the UK to leave the EU in the Brexit referendum, was elected as the party leader and UK’s next prime minister.

With Boris Johnson as the new UK prime minister, it now seems most likely that the 31 October Brexit deadline will be met.

Wall Street and US/China trade war

With Trump officially launching his 2020 re-election campaign on 18 June 2019, it seems most likely that it will be in Trump’s best interests to negotiate a trade deal with China to keep his voters confident is his ability to create a strong economy.

Remember, however, nothing is certain in today’s unpredictable international political climate, with the risk of a “Captain’s call”, sending markets into a flurry of chaos and volatility, only ever being a Tweet away.

With the All Ords having reached a new record market high, we are mid-way into the ‘Boom Phase’ of the Investment Clock.

Between 10 o’clock and 11 o’clock on the Investment Clock

The improving economy leads to more aggressive market highs. A frenzy of interest and speculation begins, marking the beginning of the end of the recovery phase, which peaks when the economy is booming and everyone believes the good times will never end, as overseas reserves continue to rise.

We are now in the ‘Boom Phase’ of the Investment Clock, meaning that the seeds of the recovery are now sown and given rising and sustainable earnings, share prices will rise as unemployment falls, commodities prices continue to increase, overseas reserves are rebuilt and property investment remains an attractive investment opportunity given gains achieved from sharemarket investment. However, this is a time where we need to become extremely cautious because at some point, in the mature stage of the ‘Boom Phase’, we will enter the ‘Greed’ cycle.

Now that we are in the ‘Boom Phase’, between 10 o’clock and 11 o’clock on the Investment Clock all the usual signals are there to tell investors they are on borrowed time.

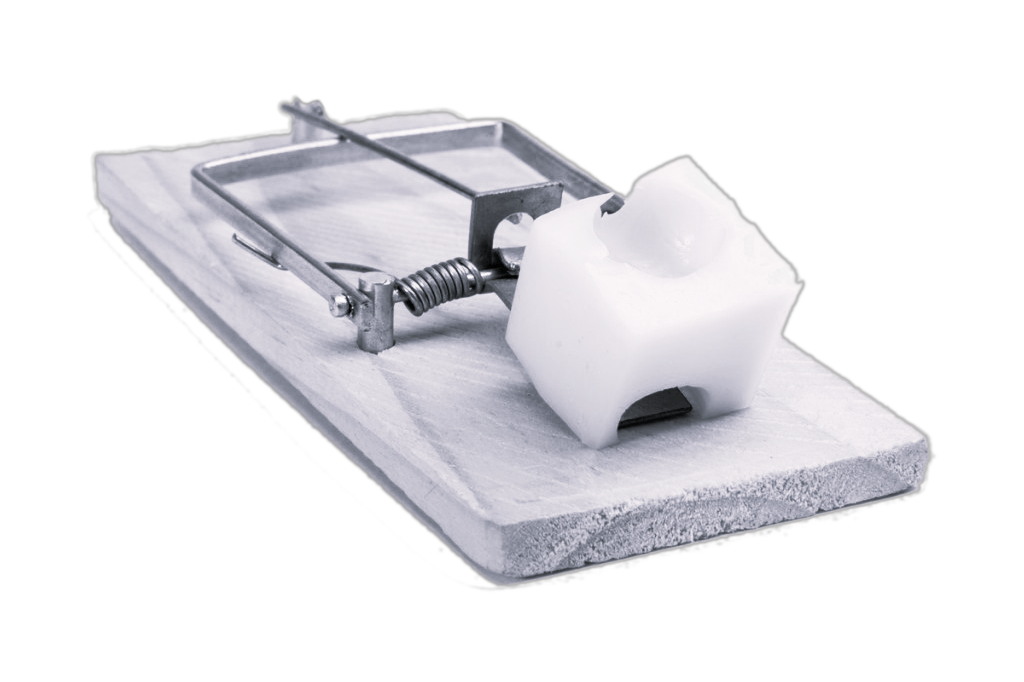

Remember that earnings, earnings, earnings will always drive share prices up. As we advance further into the ‘Boom Phase’ don’t listen to advice on shares from the taxi or Uber driver, the tennis coach or the conversation at a dinner party. Often these amateur share tipsters are providing you with information that’s like a stick of gelignite with the fuse lit and set to explode at some point. You just never know how long or short the fuse might be.

To leave you with a final thought, here are some words of wisdom given to me by my father (a 40-year stockbroking veteran), when he was entering into the hustle and bustle of the sharemarket,

“Always remember to keep your head whilst all those around you lose theirs.”