The All Ords has Finally Surpassed the All-Time High of 6,873!

Why an Index of 7,000 a Real Possibility It’s a time to take extra caution as we advance into the latest cycle and “keep your

Why an Index of 7,000 a Real Possibility It’s a time to take extra caution as we advance into the latest cycle and “keep your

2017 Prediction Earlier this year, Business News Australia reported that, “(b)ack in April last year, North said the All Ords would hit 6,000 points by the

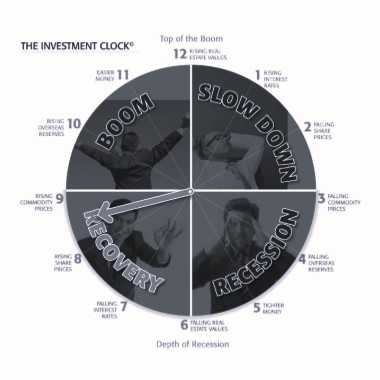

A simple guide to understanding economic and market cycles The Australian sharemarket is putting in a consolidating performance so far in 2017, with the All

1. If the overall sharemarket is rising and individual stocks are also showing the same trend upwards, don’t sell too early if the price

How Can Mining and Resource Companies Get Onto the Radar in the Media? Why do CEOs of junior explorers get it wrong when telling their

There’s no better time to think big and get your message out to the market The CEO’s of listed small-cap companies are now in the

Boom Time is a period of greed and excess. Consumerism is at its most extreme, full employment provides for maximum optimism and a feeling of real and sometimes imagined wealth exists, where investors believe that the favourable conditions will continue indefinitely. A whole range of new players come into the sharemarket at this level, and often regret having little or no knowledge, relying only on what others have told them- that sharemarket investment ‘is easy money’. Smart investors get out on the way to and at the top of the boom by taking their share gains and moving into real estate as part of a longer term wealth creation strategy. At this stage of the phase, the rapid increase in the demand for real estate often pushes demand above supply and results in an increase in property prices. Property prices may rise well above real value and can come back to bite you later, if you have excessive gearing.