How Can Mining and Resource Companies Get Onto the Radar in the Media?

Why do CEOs of junior explorers get it wrong when telling their story?

RN: CEOs of junior explorers often struggle to tell their story simply. In nine out of 10 mining-company presentations, the information is the wrong way around: too much technical detail at the start and key information about the people involved buried at the back.

What would be your recommendation on preparing a company’s communication plan?

RN: Getting early advice on the company’s communication is money well spent, the CEO needs someone to scope up a background on the management team, put together a compelling PowerPoint presentation, ensure the company speaks in a language the market can understand, and gets it messages across in the right order.

The next step is finding a balance between promoting the company and overselling it. Some CEOs tend to over-promote their company’s position and lift market expectations too high. It’s a fine line: you need to get the market excited to raise capital, but in a way that is accurate, balanced and consistent.

What relationships should CEOs be looking to build within the industry and the media?

RN: Identifying key market influencers is critical, CEOs should very early on know which analysts, brokers, fund managers and journalists are most important for the company and set out to build long-term relationships with them. It’s always better to have fewer relationships of higher quality, with people who understand the story from the beginning, than take a scattergun approach by sending press releases and market updates to everyone.

What is the best IR approach and balance for CEOs to take when it comes to marketing their company?

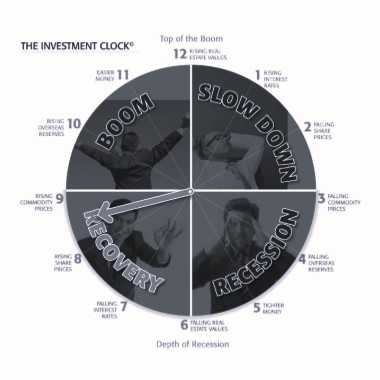

RN: Mining and Resource Company CEOs need to decide how much time they will devote to IR and which channels or events provide the best return. Many CEOs spend too much time trying to mine the market rather than mining the ground. You don’t want the CEO on road shows or at conferences every few weeks, or the company continually sending out announcements. It’s better to focus on a few key communication events every year and do them well.

What can companies do to engage with investors and get the message out?

RN: Maximising existing communication, such as quarterly reports, is a good start. Often, a company update or executive summary is not included in the quarterly cash-flow statement and it becomes a very dry financial statement. This communication is a lot more effective if it is topped up with a succinct executive summary explaining the company’s progress that quarter and maps it against its milestones and timetable.

Improving the IR component of the website is another opportunity; too many mining-company websites do not have a strong IR section. In this digital age, you have to provide information that is transparent, immediate and accessible to investors worldwide. If you don’t, you are missing a huge opportunity to reach current and prospective investors.

What alternative channels are available to CEOs to reach people and investors in the industry?

RN: Trade publications and investment newsletters that cover resource stocks are useful IR channels. A lot of newsletters and mining magazines are well read by people in the industry and those who invest in it. These publications are especially important for exploration companies that are not researched by broking firms and need an independent endorsement of their story.

Social media is also underutilised, mining companies must keep an eye on investment forums such as Hot Copper to understand how the market perceives them. Yes, a lot of people post using pseudonyms but some of the feedback can be useful from an IR perspective. Twitter, YouTube and other social media channels are cost-effective ways for mining companies to get their message out there quickly in a global market.